Personal finance for Civil servants and CPSE officers

Your Financial Saarthi.

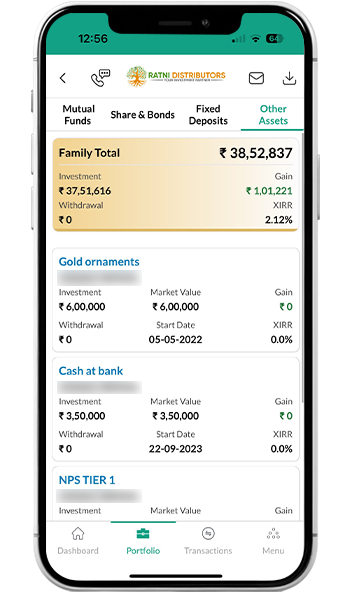

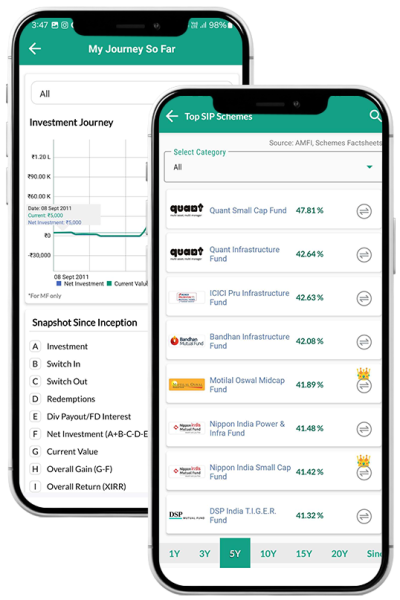

All your Investments in one place

Manage all your Investments, Insurance, Goals,

taxes etc in one place

Mission 1 Million: Creating Financial Awareness

10,000+

lives touched

120+

Investor Awareness Programs

26+

CPSEs

Google Reviews

R.N. Vishwakarma

12:05 19 Feb 26

Pankaj Sandhu

12:04 19 Feb 26

Satisfactory and interesting

VIVEK SRIVASTAVA

12:03 19 Feb 26

pallavi mishra

12:03 19 Feb 26

Neeraj Kumar

11:38 09 Feb 26

Very good

Sunny Seth

11:34 09 Feb 26

sanjeeta singh

11:33 09 Feb 26

Shri Rahul Jain gave a complete guidance of how to start investing.

srinivas PULI

10:26 09 Feb 26

Ak Sharma

16:00 30 Jan 26

Very useful information is shared here

sk ghulyani

04:25 03 Jan 26

Great ! All the sessions being condcuted by Rahul Sir are very imformative, educattive and adding value to my superannauted life. Keep going. Spread the financial literacy which is very relevant for the India Growth Story.

Naresh Ramteke

08:16 19 Dec 25

JYOTI PANDYA

07:18 19 Dec 25

Very effective session.

Harbans Taneja

07:17 19 Dec 25

Very well explained the financial planning after superannuation. Thanks for the valuable information

🙂

🙂

SUNIL AMBHURKAR

07:17 19 Dec 25

Insight on financial planning explained in simple way.

BIJAY SWAIN

11:17 06 Dec 25

The session was very informative and i learnt a lot regarding how to plan for your future goals.

ADARSH PRASAD

21:04 17 Sep 25

I recently attended a financial planning session at HAL Helicopter Complex with Rahul Sir – it was extremely insightful and knowledgeable. After that, I had a detailed Zoom call with Harsh Sir for personal financial and retirement planning.

Harsh Sir explained everything very clearly, addressed all my doubts patiently, and guided me on how to plan for the future, manage responsibilities, invest retirement corpus with low risk, save taxes, and maximize returns. The way he used simple examples and stories made financial planning easy to understand, even for someone like me from an engineering background.

Harsh Sir explained everything very clearly, addressed all my doubts patiently, and guided me on how to plan for the future, manage responsibilities, invest retirement corpus with low risk, save taxes, and maximize returns. The way he used simple examples and stories made financial planning easy to understand, even for someone like me from an engineering background.

Anshul Gupta

13:46 14 Sep 25

The session was very useful. I learnt comparison between FDs and Debt mutual fund as a entire new concept.

ac srinivasan220165

14:23 17 Nov 24

Prithvi Singh

09:47 16 Nov 24

Rajesh Sinha

07:07 15 Nov 24

Useful and enhanced our confidence towards Ratni FINSERV.

RAVI NATH

13:55 12 Nov 24

Very informative and beautiful presentation linking krishna message was awesome.

It mattered a lot.

Thanks with Best wishes.

Rn

It mattered a lot.

Thanks with Best wishes.

Rn

KV James

13:31 12 Nov 24

S Gupta

05:15 02 Nov 24

Very Informative Session on financial planning, including retirement planning.

Good for youngsters who can start SIPs from beginning and for persons going to retire soon have a better planned asset management. Thanks Rahulji.

Good for youngsters who can start SIPs from beginning and for persons going to retire soon have a better planned asset management. Thanks Rahulji.

HARSHVARDHAN SINGH RATHORE

11:28 27 Aug 24

The session was truly enlightening, offering invaluable insights that have broadened my understanding. Engaging in more sessions like this would be immensely beneficial, as they would not only lay a solid foundation for my investing journey but also pave the way for long-term success.

Shagun Verma

07:19 20 Aug 24

Got to know many things.. loved the session!

Kusum

13:10 17 Jul 24

A amazing and honest one to one session.

sanghamitra lala

09:57 30 Jun 24

It was a great energetic session today and we learned a lot about investing and decision making . sir has taught us about logical thoughts and involuntary thoughts as well as importance of investing money from early age.

supriya Singh

16:08 29 Jun 24

Jewesh Chugani

15:36 29 Jun 24

The session conducted by Rahul sir today was just amazing . We made us play a game by which I got to learn a lot . The best I learnt was that we should invest in Mutual funds as we are young and have not yet started earning yet so to be on a safer site we should invest in Mutual funds . The interation with you was amazing sir got to learn a lot from you and I will definately implement all of those in my practical life . Thankyou sir .

Sandeep Yadhuvanshi

15:21 29 Jun 24

Thank you, Sir, for your valuable feedback on investing speed in I Business institute. We're thrilled to hear that our platform meets your expectations in terms of efficiency and speed. Your insights are incredibly important to us as we strive to continuously improve our services. We appreciate your support and look forward to assisting you with your future investment needs.

One again Thank you sir🤎🤎

One again Thank you sir🤎🤎

Harsh Tiwari

15:05 29 Jun 24

Never heard about any college having 50 days orientation!

So today was the 9th day and the most interesting day !

Interesting because we didn’t had like normal discussions or some q/a sessions !we played a game of debit ,credit !didn’t know much about it though i was the bookie there, two teams were divided and they had to choose some debit, credit ,gold ,initial debit out of 100.

Basically it was more clear to people who are from commerce background and do trading or put up money in stocks ,still it was interesting for me !there

So today was the 9th day and the most interesting day !

Interesting because we didn’t had like normal discussions or some q/a sessions !we played a game of debit ,credit !didn’t know much about it though i was the bookie there, two teams were divided and they had to choose some debit, credit ,gold ,initial debit out of 100.

Basically it was more clear to people who are from commerce background and do trading or put up money in stocks ,still it was interesting for me !there

Yukti Sharma

14:53 29 Jun 24

It was an amazing and informative session filled with laughter and joy. I think now I can b confident enough to face the future outcomes... Thank u for ur commendable efforts and hardwork.,... I hope u all gain excess profit in future

Puneet Srivastava

05:30 12 Jun 24

It was an excellent session. Long term investment plan, it's pros and cons were told in detail. It was an eye opener, as lot of money, we are shelling off as tax, which could have been saved with legal means.