About Us

Ratni Finserv Pvt. Ltd. is a Delhi-based, new-generation start-up providing turnkey financial solutions to individuals and corporates.

Our founder is a Certified Investment Advisor, Volatility Coach, and a member of the prestigious Financial Freedom Fraternity (FFF). He holds an MBA and is an alumnus of St. Xavier’s, with over 10 years of experience in macroeconomic research and 5+ years in advisory and family office management. Backed by a dynamic millennial team equipped with the latest technology, we ensure a seamless, paperless experience.

Under the B2C Segment: Our core expertise lies in serving HNI, UHNI, and family offices to help grow their wealth. Our founder has provided financial planning services to hundreds of civil servants and senior officials from CPSEs. We specialize in: Financial Planning, Risk Management, Tax Planning, Retirement Planning, Estate Planning, and Family Office Management.

Under the B2B Segment: We also conduct corporate training programs across CPSEs. These programs focus on: Financial Planning, Retirement Planning, Team Building, Positive Thinking, etc. The training programs are conducted directly by our founder along with an empaneled list of eminent speakers from the industry.

Our Vision: “Make your money work harder than you.” We aim to build long-term relationships and stand by your side as you grow.

Our Mission: “Create financial awareness among 1 million individuals.” In 2022, we reached over 1,000 individuals through corporate training programs and personal interactions.

Our Philosophy

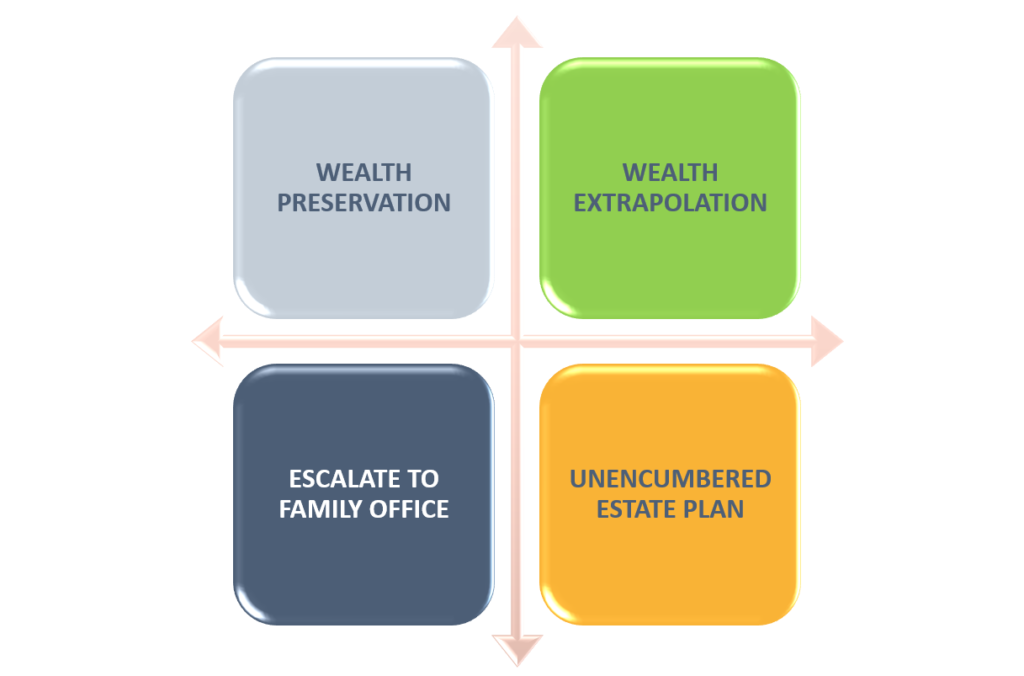

We focus on the following pillars of Investments:

- PRESERVATION of wealth by ensuring adequate insurance and safeguarding assets against internal/external risks.

- WEALTH EXTRAPOLATION involves disciplined and customized planning with regular monitoring.

- ESCALATION TO FAMILY OFFICE as wealth grows for efficient management and better tax planning.

- UNENCUMBERED ESTATE PLANNING involves passing of wealth in an efficient manner and clear directives to avoid family disputes.

These pillars should lead to MAKE YOUR MONEY WORK HARDER THAN YOU.

Investment Strategy

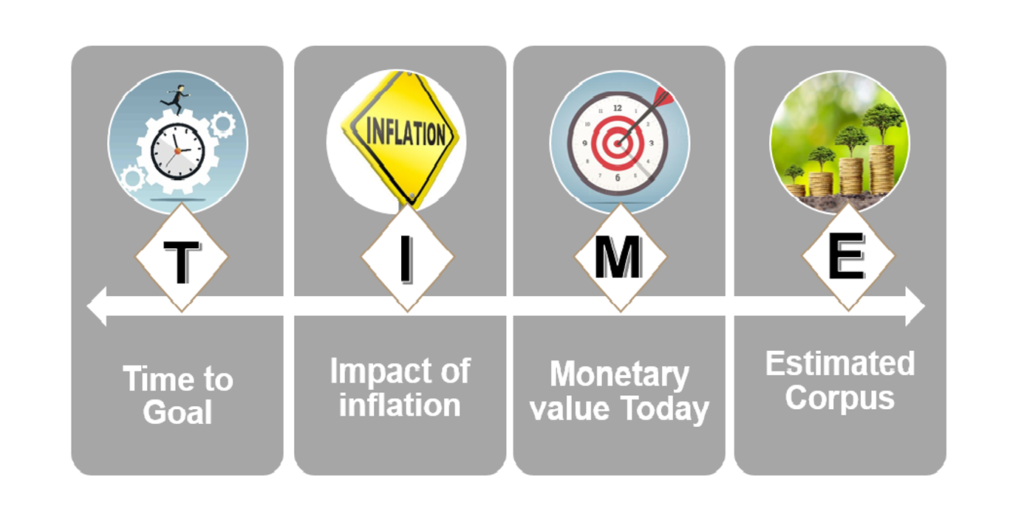

- Time To Goal – Identify the time left to achieve any particular goal. For example, my daughter is 10 years old, and I want a marriage fund when she is 25. So, 15 years is the time to goal.

- Impact of Inflation – Identify the applicable inflation rate for a particular goal. For example, the inflation applicable to the marriage fund is 7%.

- Monetary Value Today – Identify the amount needed to be spent on a goal in current value terms. For example, my daughter’s marriage today can be done with 25 lakhs.

- Estimated Corpus – Calculate the future value required based on the above factors. For example, the future value of INR 25 lakhs after 15 years at 7% inflation is approximately INR 69 lakhs.

Discounting the future value amount at the expected rate of return gives the monthly investment required to achieve this corpus. In the above example, the goal of INR 69 lakhs in 15 years may be achieved by investing INR 14,000 per month in equities at 12%.

Investment Strategy Execution

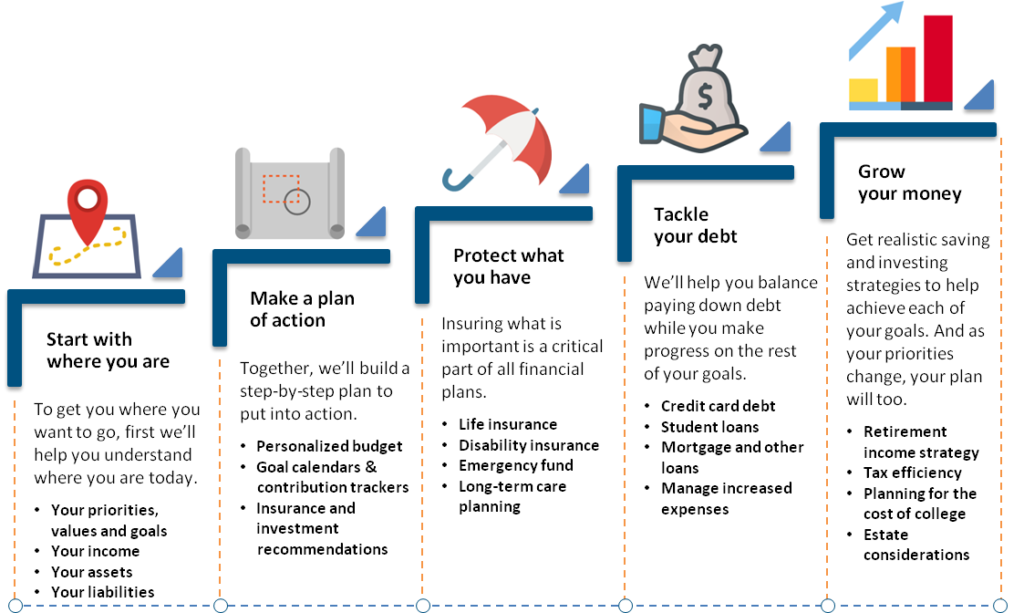

Our investment strategy is to tackle financial requirements in order of their priority.

Step 1: Create a client profile with existing assets, liabilities, and future financial responsibilities.

Step 2: Set your future financial goals and make a plan of action.

Step 3: Get yourself adequately insured first.

Step 4: Tackle your debt and prepare a repayment plan.

Step 5: Start investing in line with your plan and regularly monitor the portfolio. Review the above plan once every year.